The post Local government survey appeared first on tabsurvey | Offline Data Collection | Employee Engagement | Customer Satisfaction.

]]>Municipalities and local governments are undergoing major changes these years, as the demand for the products and services delivered are ever increasing. With citizens’ rising expectations, the need for measuring citizen satisfaction in a local government survey becomes increasingly important.

The point of performing a local government survey is to capture valid data, that in turn can be used to deliver high quality services to citizens living locally. In order to achieve this, it’s pivotal to capture as true and precise data as possible. However, this may not be as easy as it sounds. Many municipalities don’t even measure citizen satisfaction, but there are good reasons to get started. Others do measure, but are uncertain of how to achieve the best and most accurate feedback. For this reason, we have compiled some advice on how you can improve the quality of a local government survey.

Ask who about what?

The first step is to find out what you want to know, and who you want to ask. This will impact the structure of your survey and where and when you are asking questions. For instance, if you are simply evaluating how the citizens are met, then it’s a great idea to create a survey formulated like statements where the citizen can choose to what extend they agree. When you have decided on who you want to ask and what to ask them, it’s time to focus on how you will get the target group to answer.

Get a high response rate from your citizens

In order to measure your citizen satisfaction, the first thing to focus on is the sheer data collection. There are certain things to consider when you focus on how effectively your survey will harvest data – namely how you design your survey, how you ask your questions, and not least where you ask. Let’s consider the issue of survey placement first: You need to ask you questions in the right place as this will impact the amount of answers you receive massively.

It’s not really rocket science as they say – just some practical things to consider. For instance, it doesn’t make a whole lot of sense to ask a citizen about their experience with their case management while they are waiting in line for their turn. If there’s no relevance then the response rate will inevitably decline. All for the better you might say, because the citizen should have a qualified response for the survey. It’s probably also not a very good idea to place a survey kiosk in a corner, behind a houseplant on the first floor, where absolutely no one is likely to pass by anytime soon.

In order to achieve the most accurate and truthful here-and-now impression, we need to focus on the spot where the citizen is passes by or stays for a period of time. The oldest trick in the book is let the citizen show you themselves. Just observe how they move around in the buildings and then choose where to place the survey from your observations. That will enable you to target the most volume and in turn achieve the highest response rate for your local government survey. Related to this is also the citizens’ readiness to respond.

Placement is both time and place

When the citizen visits his/her local municipality for some reason, they may arrive from an entirely different place mentally. Perhaps they just came from a business meeting, or they just received a parking ticket, from picking up the kids from school. In the midst of that the citizen now needs assistance in citizens’ service. But before this can happen the citizen needs to register, find out where to go, and possibly await their turn. Eventually the citizen will leave the building and attend to whatever comes next that day. In other words, this is a kind of a journey for the citizen, which may even have started when the citizen booked an appointment online?

In order to attract any kind of attention in the midst of this journey, the citizen will demand that your inquiry is relevant. Therefore, the survey needs to be in the right place at the right time. That means in the time and place where the so-called response pain is as low as possible. Elsewhere, we have described what response pain is, but in short, it is the disruption, confusion, irritation or used energy associated with having to answer a survey. Response pain can never be completely eliminated, but will always have to be measured up against the excitement or satisfaction one can experience when voicing one’s opinion.

But when you actually find the ideal time and place to conduct your local government survey – that is after your citizens have had some kind of experience to rate, but before they are mentally and physically on with their daily lives, then that will be the golden, but elusive moment for your survey. This is where the least response pain is felt, and that is why placement is about time and place. In other words, what we are trying to achieve is the following with our survey placement: To ask the right questions to the right citizens and the right time in the citizen journey.

Leave a chance to answer truthfully

Next, we should consider the pivotal moment, when the citizen meets your survey. In other words, the way your questions are presented, how you ask, and how you end the questionnaire. Again, it’s a great idea to consider minimizing their response pain as a guiding principle. At this point they have already agreed to spend energy on responding to your local government survey – now it’s all about getting the citizen to finish the survey and do so with answers that are actually in accordance with their true beliefs.

Here, beliefs refer to eliminating the bias that inhibits human nature, and that makes us easily affected by something. Put differently, if we are annoyed or embarrassed about the questions asked, it may affect our response. It may also be that the citizen doesn’t understand the question (in which case it was probably not very well articulated), or that someone in the mayor’s office was a little too ambitious and put two or three questions into one.

It’s important that that the citizen is seen as a human being, because it signifies that it’s a real person who is asking and not ’the system’. So, when you are designing your local government survey, remember to say ’Hi’, ’Thanks’ and ’goodbye’. Tell them what is going to happen and exactly why their opinion matters.

Ask directly – it’s just less complicated

The way a question is posed is important too. A good rule of thumb is to keep it short! This could sound like the following questions:

“Was the wait time today ok?”

“How satisfied were you with today’s service?”

“How satisfied are you with our self-service solutions?”

“Are you familiar with your municipality’s solutions within XYZ?”

By asking more directly, you will obtain more valid data, that you in turn can use to improve your citizen satisfaction. Previously, we have written about designing great questionnaires, which you can read about here and here.

Many possibilities

Creating a framework, that will improve the quality of your local government survey may not prove difficult. Once you have a good structure in place for how and where you want to survey, then you can start surveying other aspects related to the citizens. For instance, you may use the same system to understand your citizens’ needs. And actually, the possibilities are almost endless, once you have the basic elements in place. All you need is to reflect on how to make the process of answering as convenient as possible. There’s lots to be gained by following a few basic principles, when you are measure citizen satisfaction. Amongst other things you may:

– Achieve a higher response rate than normally

– Get a more robust documentation of the citizen satisfaction

– Get closer to the citizens and their needs

– Get answer to what you really want to know

– Get the opportunity to follow up with unsatisfied citizens

– Signal that your municipality wants dialogue with its citizens

Enjoy measuring your citizen satisfaction!

The post Local government survey appeared first on tabsurvey | Offline Data Collection | Employee Engagement | Customer Satisfaction.

]]>The post Survey the canteen satisfaction appeared first on tabsurvey | Offline Data Collection | Employee Engagement | Customer Satisfaction.

]]>The core business is supported by good Facility Management

Success starts with a great canteen

Survey the canteen satisfaction

- Detractors. This groups will speak poorly of you or your company, and will be in the process of actively finding a new job (Usually the ones who answer smiley 1 to 3)

- Passives. This group doesnt really harm og benefit you, but within the next few years they could be looking for new job opportunities. (they are the ones who answer smiley 4).

- Promotors. The group that you want have as many of as possible, as they love working in your company and enjoy telling their peers, friends and family about it. (They answer smiley 5).

Maintain loyal employees in tough times

The post Survey the canteen satisfaction appeared first on tabsurvey | Offline Data Collection | Employee Engagement | Customer Satisfaction.

]]>The post Minimise survey bias in your on-site survey with these tweaks appeared first on tabsurvey | Offline Data Collection | Employee Engagement | Customer Satisfaction.

]]>How do you present your survey?

If you are running a kiosk-based survey, maybe fixed in a tablet case or a kiosk stand which is placed conveniently somewhere, then solely because of the technology that you choose, you are creating a certain bias, often related to either age or gender.

In the same way, if people complete your survey via exit interviews, then it’s pretty much the same deal. In any survey where you approach the respondent to learn about their experience or get their feedback, there’s bias. And it’s two-fold: The interviewer will consciously or subconsciously select her respondents from certain criteria (other than the ones defined in pre-segmentation). This could either be the personal appearance, personality type or something completely different. But the respondent’s answer also depends on the interviewer. For example, if the interviewer is a young extrovert with a lot of energy as opposed to a person who is less engaging, then responses may vary.

So, no matter if you are doing your on-site surveys via interviews or survey stations, there’s bias!

Where do you place your survey?

An entirely different issue is where people complete your survey. Assume that you are bringing your car in for service. Do you think that your answers would differ, if you took the survey while in the waiting area, drinking coffee or if you were on your way out of the dealership? Chances are that you would make more of an effort to give a more accurate and descriptive answer, if you were sitting in the waiting area, right? I mean, if you’re heading out the door, you’re not going to invest as much time in answering because mentally you are already leaving the establishment.

Most organisations are interested in the service experience and hence they want to ask their customers when the experience is complete, but there’s always a trade-off between how much data you will get vs. how full a response you get.

Survey design is important in order to minimise survey bias

The survey design itself is important. How you ask your questions, what conditional clauses are built into the questions etc. – i.e. is the respondent even able to answer the question properly?

Firstly, simply putting the survey questions in an order which is logical for the respondent is important. For instance, if the survey is about a service experience, then it’s important to ensure that the respondent has had an experience of some kind, meaning have they browsed, purchased, or been in contact with service staff. Therefore, it will always be key to ensure that the respondent has the fundamental ability to answer a given question. You can solve this problem easily by filtering the respondents so that they only see with relevant questions. In tabsurvey, we ensure this by introducing a simple flow in the survey.

Question phrasing

Another typical pitfall in a survey is the question phrasing. Phrasing a question with bias, is unfortunately quite common. Consider an employee survey, that examines employee satisfaction and maybe the level of stress in the organisation. Now consider the question: “On a scale from 1 to 5, how stressed do you currently feel?”. Well, the employee who doesn’t feel stressed at all, has no way of answering this question accurately. Even a 1-score, will indicate that she feels a little stressed out. So, the lesson is to be attentive to the phrasing of the question, as it otherwise won’t minimise survey bias.

The right predefined choices

Along the same lines, creating a question with predefined choices (single or multiple choice questions) can create bias. It could be as simple as “Where did you hear about us?” followed by a list of choices. But if the respondent’s preferred choice is not among them, then there’s bias. The solution is to always have an “Other” field, where the respondent can fill in a text-based answer. It may seem trivial, but nonetheless the “Other” choice is often not included in the list of choices. As a result, the respondent is unable to express her true opinion.

So, there it is. Use these simple guidelines when you conduct your surveys and you’re sure to minimise survey bias to the extent possible.

The post Minimise survey bias in your on-site survey with these tweaks appeared first on tabsurvey | Offline Data Collection | Employee Engagement | Customer Satisfaction.

]]>The post Easily manage sales leads on events appeared first on tabsurvey | Offline Data Collection | Employee Engagement | Customer Satisfaction.

]]>What’s TechBBQ?

TechBBQ is hosted in Copenhagen and is a two-day international tech-startup summit by and for the startup community. Every year a dedicated team works tirelessly to link entrepreneurs with the rest of world, providing startup ecosystems with cutting edge insights, business opportunities and networking.

In 2018 the summit outgrew itself for the fifth year in a row. Hence, more than 6,000 local and international startups, tech talents, innovative minds, visionary corporates, prominent investors and pioneering speakers participated.

The next generation of content writing

One of the participating startups was JumpStory – a Danish company co-founded by Jonathan Løw and Anders Thiim Harder. JumpStory rethinks digital communication and marketing as they assist small and large organizations in writing blog posts, SEO articles, Newsletter and SoMe posts. According to Jonathan Løw, what makes JumpStory different to many others is that they use artificial intelligence in the process instead of content writers.

As an exhibitor on the TechBBQ event, JumpStory wanted to maximize customer engagement and therefore they approached tabsurvey to make use of its lead-generation tool for trade fairs and events.

How to manage sales leads on events

If you’ve ever been an exhibitor at a trade fair or event, maybe you know the feeling. The traffic and interest for your booth varies. At times it’s really slow and you and your colleagues have a hard time keeping focus. At other times, the booth is over-crowded with visitors who have all sorts of questions or comments, and you don’t really get to engage with everyone. Annoying right?

To solve this problem, tabsurvey delivered a complete solution to help JumpStory manage sales leads on events. The solution included two iPads, two iPad stands, chargers and cables and a digital signup form and survey to engage with visitors and potential new customers.

In addition to the two lead capture stations (stands), JumpStory had two employees, each with a handheld device harvesting leads. With four active channels active throughout the two days, they were able to capture all potential interest at all times.

Results

According the Jonathan Løw, the TechBBQ event was a massive success. Not only did JumpStory engage with hundreds of visitors, they also managed to capture a lot of sales leads. During the two days of the event they managed to get 500+ signups. Of the 500 signups, a staggering 96 percent were positive towards being contacted again after the event. Almost 500 leads isn’t bad for two days work, right?

Do you a trade fair coming up, and want manage sales leads on events? Don’t hesitate to sign up or contact us for more information.

The post Easily manage sales leads on events appeared first on tabsurvey | Offline Data Collection | Employee Engagement | Customer Satisfaction.

]]>The post How to increase response rate for surveys on the go appeared first on tabsurvey | Offline Data Collection | Employee Engagement | Customer Satisfaction.

]]>What are Surveys On The Go?

By Surveys On The Go I mean the type of survey which are available in the physical space and captures responses quickly and here and now. Obviously, the survey itself matters: the questions you ask and how your engage with your visiting audience. If you are interested in survey design in general and which survey strategy to adapt, you can read about it here and here. However, there are some other, external factors that can affect your response rate. One of these elements are the respondent turnover rate.

What is your respondent turnover rate?

The respondent turnover rate is defined by how quickly the population of respondents (surveyees) changes over time in the physical location you are surveying. For instance, if you are a retailer, and you are surveying your visiting customers, then your respondent turnover rate would be the number of new visitors your store gets divided by the number of total visitors. Imagine that your store receives 1,000 monthly visitors. Of these 300 visited your store the month before, and so they are repeat visitors. Your respondent turnover rate would be (300/1,000) x 100 = 30 percent.

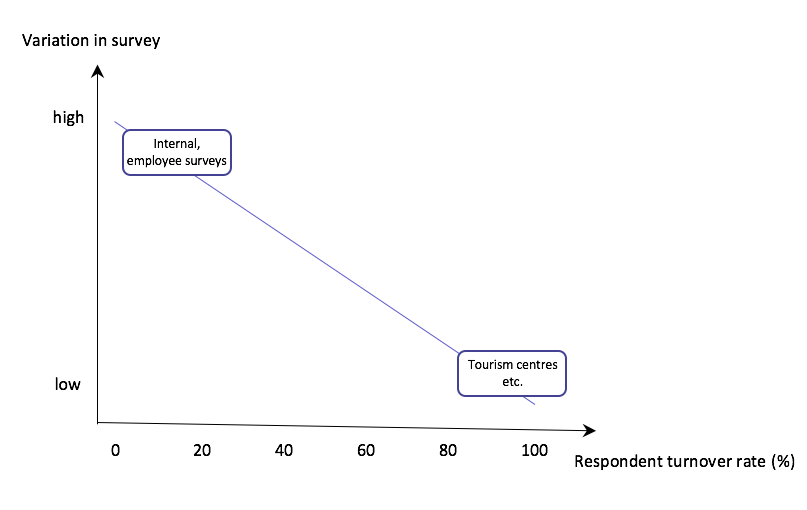

A place where the turnover rate is even higher would be in a Tourism Information Center or Welcoming Center. Naturally, the turnover rate would be high here because very few tourists would visit a welcoming center more than once. Therefore, the turnover rate would be close to 100 percent, as almost every visitor is new and unique.

At the other end of the scale, consider the cafeteria of a company. The employees here are asked about the satisfaction with the warm meal – every day. The respondent turnover rate here is close to zero.

In the examples given above, the overall motivation for answering a survey is, among other factors, dependent on the respondent turnover rate. I.e. the more times the respondent sees the same survey, the less motivated she would be to answer it. This is why you cannot apply the same kind of logic when performing, say, an employee engagement survey and a visitor center survey. Apart from the fact that there is a big difference in the composition of the respondents, there are some other factors that could affect your response rates.

Asking someone raises their expectations

Consider your company was surveying you in your cafeteria every day and that they asked the same question everyday: ”How did you like the warm dish today?”. The first time they ask, you rate it mediocre and comment that the chicken was dry. The following week, you get chicken again, and guess what: It’s still dry. When experiencing the dry chicken once again the third week, you simply don’t answer anymore, because what’s the point, right?

The lesson to be learned is that the lower the turnover rate of the respondents is, the more important it is for you as survey creator to ensure that the surveys you present are variated. Please see the below graph depicting a simplified correlation between survey variation and respondent turnover rate.

Ways to increase the response rate if respondent turnover rate is low

Areas where the respondent turnover rate is typically low includes: Internal employee engagement surveys, facility management services (like printing, cleaning, cafeteria etc.), educational institutions, and food businesses that have a very frequent, regular customer base.

For these and related segments, we recommend some of the following ways to increase the response rate for your surveys.

- Stop-go approach. One solution is not to monitor continuously, but instead apply a stop-go approach. For instance, to survey for 1-2 weeks and then stop the survey for another 1-2 weeks.

- Acknowledge and visualise results. In itself or in conjunction with the stop-go approach, a good way to spend the weeks of not surveying would be to acknowledge the feedback received, for instance by sharing the feedback with the respondents (customers, visitors, employees). This would create a common understanding of what feedback was given and identify what, if anything, needs to be changed.

- Act. Acting on the results from any survey ensures high motivation from the respondents and raises the chances of higher completion rates in the future.

- Change some questions. Keep some overall base questions but vary others to keep the survey from being too boring.

Dry chicken example revisited

So if you are asking about the warm meal of the day. Then follow up in the coming weeks with a different question, like: ”Is the chicken still dry?” or “If we were to change the menu away from chicken, what would you prefer, we changed it to?” (with alternatives). That way, you are signaling that you are actually listening and want to improve the services you provide.

Anyway, would love to hear your thoughts on this subject. Have you or are you performing surveys on the go in areas where the same people are passing through? How do you engage your respondents?

The post How to increase response rate for surveys on the go appeared first on tabsurvey | Offline Data Collection | Employee Engagement | Customer Satisfaction.

]]>The post How To Exceed Expectations In The Customer Experience appeared first on tabsurvey | Offline Data Collection | Employee Engagement | Customer Satisfaction.

]]>However, the CrossFit gym didn’t stop sending me newsletter emails and updates (which I thought was quite annoying). It finally became too much for me and I replied to one of the emails. In the header I wrote “unsubscribe, please”. I figured, that would be that, and didn’t give it much thought.

But some days later I received an email from the gym. Like many others, I receive a lot of automated emails in my inbox, so getting one which wasn’t, naturally caught my interest. The header said “Unsubscribe and a little more”. It was a personal note from the gym manager, Ed, who had started at the gym after I had left.

Getting more than you expect really matters

Ed wrote to me that he had been told that I used to be quite an active member once and that he had also learned about my injury. He offered me a free session, where he would try to understand my injuries and help me get better. At this point I had been seeing so many different types of doctors and specialists, all arguing different cases and courses of treatment for my injury, and all unsuccessful.

So, I figured that I had nothing to lose and took him up on his offer. Realising that he was probably doing this to get me back as a member, he still was able to exceed expectations by offering me something and not expecting anything in return. If you’ve tried it, you will probably agree that it’s actually quite moving when someone outside your own family or circle of friends takes an interest in your well-being.

Anyway, I went to meet with Ed, and we had a good session. He gave me some pointers to what I should and shouldn’t be doing and worked with me to sort out what was the underlying reasons for my injury.

That day, I had planned to pick up my training shoes, my jump rope and some other training gear from the gym, but when leaving I changed my mind. Suddenly, I was thinking that I might as well leave the gear, since I would need it once I was completely over my back injury and joined the gym again!

As an extra follow up with me, Ed sent me personalised video that same day, summing up the points we had gone over, so I could always revisit the points he had made. Talk about making the effort to exceed expectations in the customer experience!

How is your customer experience?

So why write this post? Well, we should all remember that even when you are losing your customer, it’s never too late to win them back. But, automated emails aren’t always going to do the job. Sometimes it takes some personal effort to exceed expectations in the customer experience.

Do you want to learn more about managing the customer experience or how to engage more with visiting customers? Then read on here and here. Stay tuned!

The post How To Exceed Expectations In The Customer Experience appeared first on tabsurvey | Offline Data Collection | Employee Engagement | Customer Satisfaction.

]]>The post Best questions for a patient satisfaction survey appeared first on tabsurvey | Offline Data Collection | Employee Engagement | Customer Satisfaction.

]]>I remember when tabsurvey first started out as a Software as a Service (SaaS) company. For a few years we had been selling our service to customers that we approached directly. Either through cold canvassing or our network. But one day back in February 2012, we launched our service online for anyone to sign up for and try. It was quite existing for us, and I clearly remember our first signup. It was an Australian hospital, and their patient satisfaction survey was titled: Patient Centered Care. Since then other hospitals and medical institutions have started using our service for conducting patient satisfaction surveys of different kinds.

In this blog post I will deal with some issues related to patient satisfaction surveys. Firstly, the importance of conducting patient satisfaction surveys in the first place. Secondly, how a patient satisfaction survey differs from other satisfaction surveys in nature. Finally, I will address which key issues to focus on, what questions to ask, and lastly, how to ask them.

Why perform a patient satisfaction survey?

I have lived most of my life in Denmark, where we have a free and fairly well-functioning healthcare system. Therefore, you may ask yourself why it’s important to survey patients. You could argue that since there’s a public system in place, there really isn’t much of an alternative.

However, under different governments, the public healthcare system has been subject to large cost-saving initiatives. At the same time, we expect the same services for less money. Cutbacks, restructuring of work processes and new IT-systems are all part of the new reality for doctors, nurses and all other employees. As a consequence, and for various reasons, the public healthcare system needs to prove a point. It needs to prove to patients, politicians and society in general that it cares about the services it provides and patient satisfaction.

The private healthcare sector hasn’t not been subject to the same political pressure, but still it finds itself in an increasingly competitive market. Over the past 15-20 years, the use of private healthcare has been become popular in Denmark. So, not only is personal health a very important matter to most people, making related KPIs important to track. The sector is also subject to increased competition, which means that patient satisfaction becomes a business critical KPI. Both in the private and public healthcare sector.

Most countries in the world don’t have public healthcare, and for that reason running patient satisfaction surveys is even more relevant. There are some pitfalls, however, which I will address below.

Focus areas for patient satisfaction surveys

You know the term “the customer is always right”, right? In retail surveys we assume that making the customer happy and satisfied will yield positive ratings and more business. If the customer purchases an item for a competitive price and receives good service, then we expect the feedback to be positive. However, when dealing with healthcare, there’s a distinction between what a patient needs and what a patient wants.

Let me give you an example: A patient is receiving treatment for her back injuries. Between her and a medical specialist in charge there’s a discussion regarding the course for the treatment. The patient wants an operation, but the specialist advocates back exercises and pain-killers – a more moderate approach. Consequently, the patient may rate her treatment poorly even though the suggestions from the medical specialist were the best approach. In such a case, high overall satisfaction may not necessarily be the end gold in itself, but a range of benchmark criteria could be.

According to the Hospital Consumer Assessment of Healthcare Providers and Systems (HCAHPS) the following nine areas are key to a patient satisfaction survey:

- Communication with doctors

- Communication with nurses

- Responsiveness of hospital staff

- Pain management

- Communication about medicines

- Discharge information

- Cleanliness of the hospital environment

- Quietness of the hospital environment

- Transition of care

These key areas would be accompanied by various questions about demographics. As you can probably tell from the above, a lot of focus revolves around communication and information, and this plays well into the strategy of Patient Centered Care.

Patient Centered Care as a guiding principle

Simply put, patient centered care is a strategy or philosophy where all activities in a hospital or other medical facility is mapped to the patient’s needs. According to NEJM Catalyst Patient Centered Care means that: “…the healthcare system’s mission, vision, values, leadership, and quality-improvement drivers are aligned to patient-centered goals.” They list six other criteria, e.g. the delivery of care, physical comfort, patient preferences, the role of patient families and how information is shared.

NEJM goes on to say that one of the benefits of Patient Centered Care is “improved satisfaction scores among patients and their families”. That means that some of the elements of patient centered care can be surveyed and hence become important KPIs for further scrutiny. This is why patient satisfaction surveys support patient centered care so well. It simply ensures that there’s a constant focus on the patient’s goals.

Take for instance the element of communication and information. From a patient point of view, it can be fairly easy to recall how she feels informed and communicated to, but for the responsible doctor or nurse, who sees maybe 25 patients in one day, it can be difficult to recall the dialogue, or the process around the handover of patient information etc. Hence, it’s difficult to reflect on a single patient’s feedback especially if its presented in a monthly or quarterly satisfaction report.

Best questions for a patient satisfaction survey

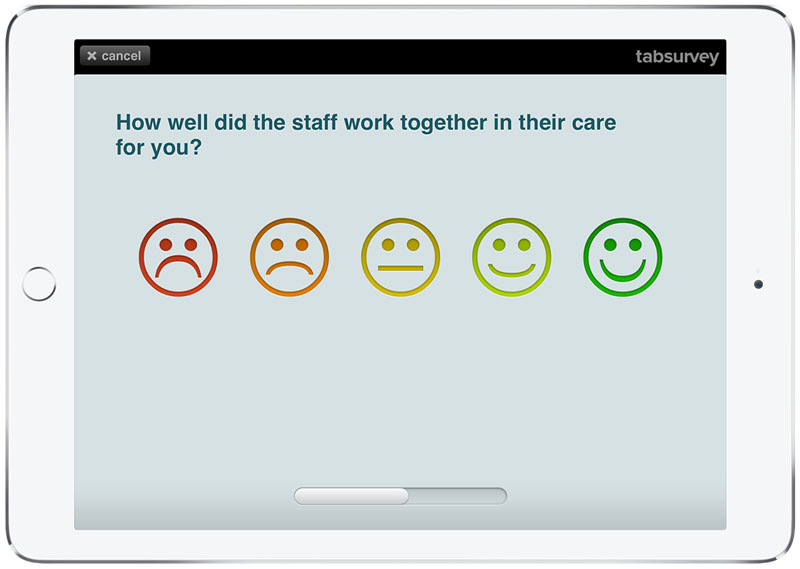

Using a tablet-based survey service like tabsurvey can serve as an enabler for dialogue, feedback, understanding and eventually better patient retention. We propose a two-tier strategy where you survey satisfaction on the day-to-day interactions with quick surveys.

Bearing in mind the focus areas mentioned earlier in this post, some of the best questions for patient satisfaction surveys include:

- How would you rate the communication with medical staff today?

- Did the care provider listen to your questions or concerns?

- How well did the staff work together in their care for you?

- Do you have confidence in your current care provider?

- How well were you informed about the procedure you are undergoing today?

- Based on your most recent experience, would you recommend our clinic to a family member or friend?

- Were our staff friendly and forthcoming today?

The purpose of these questions is to ensure that all personnel strive towards the underlying KPIs. These KPIs are, in turn, often linked to vision, mission, values and culture. In other words when people know what KPIs they are measured on, then their behaviour will automatically follow.

The long term KPIs, which would focus on the long term goals of a treatment (i.e. being cured), would not be part of the survey, as respondents would not be able to answer properly until a certain period of time had passed. The medical staff could present such questions on a follow-up consultation or as a survey link via an email.

Hope you enjoyed today’s post and hope that you might start using tabsurvey for your patient satisfaction survey.

The post Best questions for a patient satisfaction survey appeared first on tabsurvey | Offline Data Collection | Employee Engagement | Customer Satisfaction.

]]>The post Best Alternatives to Mystery Shopping appeared first on tabsurvey | Offline Data Collection | Employee Engagement | Customer Satisfaction.

]]>In today’s blog post I’ll discuss why I believe that mystery shopping is becoming increasingly irrelevant in today’s retail world. I’ll also touch upon what the best alternatives to mystery shopping are.

What is mystery shopping?

I used to work for a company that was in the business of mystery shopping. For those of you who don’t know want mystery shopping is let me explain. It’s a way to investigate if a physical store is living up to certain KPIs or standards. The KPIs could be service levels, store interior or if certain procedures were followed. Questions like “How well did the sales representative ask open-ended questions” or “How did the sales representative present alternatives for the customer that fit customer needs” would be quite typical questions.

Often well-renowned companies would pay mystery shoppers to appear unannounced (it’s a mystery shopper, remember?) to make a purchase or at least pretend they would.

After the visit, the shopper would write down his or her report based on the predefined KPIs and questions. Once these were noted down on paper outside the store, she would find a computer and enter the data in a web form. The end result would be a report to be presented to service executives and store managers.

I remember the hassle of working with the network of shoppers. Sometimes I would have to ask distant family members for favors, because a shopper had made a last minute cancellation. Sometimes I would even have to make the long drive to a location myself just to make the fake purchase. However, the service was quite popular for retail companies in particular.

Mystery Shopping as a performance tool

Many companies would use the reports to set up balanced score card reports. These would in turn be used for employee incentive programs and bonus payments.

Quite unfair, in some instances, as the store personnel often knew what the mystery shopper looked like, because it often would be the same shoppers for specific retail chains, or because the shopper always appeared at the exact same period of the month, or in the same vehicle and presented themselves in non-credible way.

An example could be a mystery shopper paying a BMW dealership a surprise visit on a bike. He would even into the store with his bicycle helmet still on! Of course he could have just won the lottery, and then decided to upgrade his means of transportation, but then again those odds are pretty slim at best. Sometimes the store would complain internally, arguing (rightfully) that the customer wasn’t credible enough.

Selling mystery shopping back in the day

However, there was no alternative back then, so the mystery shopping reports sold quite well. They could also be used as a door opener for new business. The telephone conversation would go something like this: “Good morning, sir/madam. I’m calling from xx. I wanted to let you know that we recently visited three of your stores in X area. Our mystery shoppers discovered some interesting patterns in the service experience in these stores, which we would like to share with you in a meeting. For free – no strings attached”.

If the potential client accepted (and they often did), then we would need to go and make those mystery visits happen (because obviously we didn’t make that investment, before it was necessary), and prepare a report. And quite often we would land the client for more mystery shopping business or, even better, some consulting work.

The future for mystery shopping

So what does the future look like for mystery shopping? Well, here at tabsurvey we believe its part of a dying breed for four reasons:

1. Fake customers

Firstly, there’s the issue of asking real vs. fake customers. Most retailers would surely like the opinion of real customers rather than that of a fake customer. Bearing in mind that there are questions you couldn’t possibly ask a real customer – like:

- “Were all lights in the store lit?”

- “Did the sales person wear a visible nametag?” or

- “Did the sales person try to up-sell?”

questions for mystery shopper– all questions that, although relevant for an audit, most real world customers either would not want to or would not feel comfortable answering. So I guess if the questions that a company wants to have answered are mostly concerned with store audit or internal standards and procedures (that no real customers care about), then they should definitely continue using mystery shopping.

2. High cost

Secondly, there’s the cost involved. In a mystery shopping context, there’s human effort and billable hours involved. Ten years ago in Denmark, an average, fairly uncomplicated mystery shopping visit would cost anything between €100-€150 per visit (roughly $120-$175), which, compared to the investment for an iPad Survey Kiosk App system, would pay a software license for 8 months (assuming €19 per month). Then you also need some hardware, but still it, by far, outweighs the cost of mystery shopping.

3. Low feedback volume

Thirdly, there’s the sheer volume of responses. Based on our data, it’s reasonable to assume a hit rate of between 1-3 percent in high volume traffic retail outlets. Assuming traffic in a store is 1,000 visits per month, wouldn’t you rather be getting between 10 and 30 responses than just a single?

4. Feedback lag

Finally, there’s the timing issue. Having worked with establishing sound feedback cultures in organizations in my prior work life, I know that getting feedback on your behavior, that stretches more than a few weeks back, simply doesn’t have any impact in terms of changing behavior. So what’s the point if, as an employee, you’re receiving feedback on your ability to ask relevant open-ended questions, if that experience lies back one month. It doesn’t make much sense.

For all these reasons it’s therefore important to identify the best alternatives to mystery shopping. We’ll address that briefly below.

Best Alternatives to Mystery Shopping

So it’s good news that since the 90s and 00s, great alternatives have become available. Today, one of the best alternatives to mystery shopping for retail is in-store surveys. They have become quite popular, as they offer real customer feedback in real-time, and in a much more cost-effective way.

Systems that engage with the customer via their phone, or through tablet-based or kiosk-based platforms are also becoming increasingly popular. Proprietary systems with mechanical buttons are also getting market share, offering a more simple (and less demanding) input from respondents, but simultaneously also giving less degrees of freedom in the type of survey your want to give your customers. Finally, there’s the transactional or post-purchase-surveys that are effective, but only focus solely on the purchaser and not the non-purchasers.

We hope you found this month’s post interesting. Please post a comment below if you have something on your mind.

The post Best Alternatives to Mystery Shopping appeared first on tabsurvey | Offline Data Collection | Employee Engagement | Customer Satisfaction.

]]>The post Best tips for using a survey app appeared first on tabsurvey | Offline Data Collection | Employee Engagement | Customer Satisfaction.

]]>Why should I be using a survey app in the first place?

Well, a native app holds some advantages over a basic online survey. First and foremost, it’s not dependent on having stabile network connection. Should the connection fail, then the survey answers will be stored offline in the app until the connection is re-established. Apart from giving the surveyor more data security, this also adds to the positive experience of the survey responder.

What’s important when using a survey app?

There are several things you need to consider. The below points largely deal with the practical aspects of the setting up a solution, and what to be aware of, if you want a hassle-free implementation.

Location, location, location…

One of the most important factors is the location of your survey. If you are placing a high-end product like an iPad somewhere in a physical environment, location is an important factor. This is because it very much affects the security measures you need to consider for the solution.

Where you want to place your survey station depends on what you want to examine and what experience or emotion you want to capture. If you are considering surveying a retail store, you should read this blog on survey placement, which explains in depth how to get good results.

But for now, let’s assume that you want to survey the customer experience near the exit of a shopping mall. From a survey perspective, the first thing you need to consider is if the survey station is secure. The less secure the location, the more you should be attentive to the security aspects of your installation.

Protecting your survey station

If you’re not planning to use facilitating personnel when you conduct your surveys, then security becomes even more important. The security aspects of placing an iPad in a semi-public location pose two security concerns. Namely how to secure your hardware and how to secure your software. We’ll address them both below.

Securing your survey app

Firstly, you need to make sure that responders or outsiders are unable to exit the survey app. We have seen examples (obviously not with our app!) where outsiders have been successful in exiting a survey app, and playing disturbing videos to the outrage of casual by-passers. This reflects poorly on the company who is conducting the surveys and the consequences could be severe.

However, there are solutions available. One option is to use Apple’s volume purchasing program (VPP) and distribute the survey app through Mobile Device Management (MDM) software. The MDM software can ensure restricted access to the iPad and disable certain hardware buttons, and thus facilitate the deployment and administration of a survey app. Leading vendors within this space include Miradore, AirWatch and Xenmobile by Citrix.

If you are using a survey app in a few locations and don’t have access to MDM software, another option is use Apple’s own guided access to restrict access. Although, guided access basically provides the same core functionality for free and works just fine, we only recommend using this approach if you have five locations or less, as it involves the administration of Apple ids and lacks a centralized deployment process and overall monitoring.

Securing your survey station

Even though you have made sure that no one can start other apps on the device, you also need to consider how to secure the iPad and the iPad stand that you are using. When you are considering iPad stands, there are several options out there. Here, at tabsurvey we have had the opportunity to work with several products. Two stand out.

If your need is an elegant solution, that should endure an highly dynamic environment, and where there’s a risk of theft or vandalism, then our recommendation is the lockable iPad case or stand from BOX IT Design. With thousands of installations worldwide, BOX IT Design’s products have by far proved themselves to be durable and well-designed high-end options.

However, should your needs for an iPad stand be different, because your survey is internal or placed in a supervised area, then a great alternative are the stands from Armour Dog. Armour Dog delivers a cost-effective alternative, which is mainly available as table stands.

With both products you can mount the stands onto a surface like a floor, a wall or a table. You can also acquire a steel wire with a padlock, if you want to secure the stand further.

Utilities and infrastructure

Once you have made the appropriate decisions regarding security, there are still a few other things to pay attention to. One is something as basic as ensuring that you place the iPad and stand near a power outlet. It may seem trivial, but if your device runs out of power, then it won’t be collecting answers for you!

Another issue is the Internet connection. Even though the app can run without an Internet connection, it will not transfer data to your online reports unless there’s a live connection. A time-limited guest wi-fi with login enabled via browser won’t do the trick, as they it will kick off it’s users after 24 or 48 hours. If you must use Wi-Fi, make sure that it’s a reliable internal (preferable hidden) network, or a cellular-based Internet connection. In either case it’s important that the connection is stable and strong.

If you have considered all of the above points, and made the appropriate choices then you are definitely on track to using a survey app successfully.

Conclusion

This blog post primarily dealt with the practical issues, which you will face as a project manager, store manager or implementation partner when using a survey app to run surveys. The things to consider include:

- Finding the right location for your survey station

- Taking the appropriate measures for securing your hardware and software; and lastly

- Ensuring that the necessary infrastructure requirements are present

Be sure to read our next blog, which will give pointers to a successful implementation of a customer experience management project from an organisational involvement point of view. Stay tuned!

The post Best tips for using a survey app appeared first on tabsurvey | Offline Data Collection | Employee Engagement | Customer Satisfaction.

]]>The post The curse of post purchase surveys appeared first on tabsurvey | Offline Data Collection | Employee Engagement | Customer Satisfaction.

]]>Less than half an hour after his visit, I received a text message asking me to rate my experience. I was kind of baffled by the question, as I wasn’t sure whether I was supposed to rate the way he rang my door bell, or the way he entered my home, or how he way he sat quietly in the corner of my living room doing his job. Because that’s what he did – his job. I wasn’t sure how to respond to the survey, as I didn’t see how my experience could have been improved. I was indifferent. Or to put it differently, I guess my experience lived up to my minimum expectations. The minimum expectation being that I had a working Internet connection once the technician had left.

What is the purpose of post purchase surveys?

Post purchase surveys are here to stay. The trend seems to be to seek out feedback from the existing customer base and ask for feedback on some part of their experience. However, there are some inherent problems with performing these surveys.

Firstly, I guess the real issue is to understand what the core purpose of post purchase surveys is. If it’s to understand and improve the customer experience of the existing customers, then it’s obviously a great idea to shoot someone an email containing a survey with a few questions.

However, the surveyor should be aware that by segmenting their visitors in this way, they exclude an important segment, who’s voice is important.

Shoe store example

Imagine that you are the proud owner of a shoe store. Within one hour, three potential customers enter your store. Two of them purchase a pair of shoes each. The third leaves without buying anything. This is not an unlikely scenario, as research shows that one in three customers leave a retail store empty handedly.

Now, if you had to choose between which one of the three you would like feedback from, which one would you pick? Well, if you’re the type of business owner or a store manager who wants your shoe store to grow through improved customer experience, then you know that you would have to pick the non-purchaser, right? The customers who already made a purchase has, by their actions, already proven that what you had to offer was enough to convince them to purchase.

Sure, by asking about her experience you can fine-tune the customer experience. But if these surveys are supposed to help understand customer experiences, then why only settle for the purchasing customer base?

Post purchase surveys surely serve a purpose, but for it to make sense, you should ask everybody, not only the ones who purchase.

Choosing convenience over curiosity

There are several reasons why many businesses within the service and retail industry use post-purchase surveys. The practical reasons include: Customer contact data is readily available and hence it’s easy to send off an email.

There are several reasons why many businesses within the service and retail industry use post-purchase surveys. The practical reasons include: Customer contact data is readily available and hence it’s easy to send off an email.

Secondly, if data about the purchase itself is available then the survey response is further enriched by this data. This makes it an important data set for further analysis.

Finally, the feedback that you receive from people who chose to do business with you, is already segmented. That means that you are probably going to get feedback that resonates well with the self image that you have created for yourself. In other words: This is the kind of feedback that will contribute to sustaining status quo.

Focus on the non-purchasers and learn more

On the other hand, obtaining feedback from non-purchasers is tricky. Contact details may not be available, which means that you have to rely on a pull strategy to attract your responders. Data about the purchase isn’t available, and the feedback could potentially be more difficult to work with.

So why go for the non-purchasers? Well, I would argue that it’s because the feedback that you least want to hear (and let’s face it, the people who didn’t purchase are probably inclined to criticize something in your store) is often the feedback that you learn the most from.

However, being open to receiving that kind of feedback isn’t for everyone. It depends on what kind of feedback culture that exists in the organization and that’s an entirely different blog post!

Be sure to stay tuned for new posts, visit some of our most recent blog post here.

The post The curse of post purchase surveys appeared first on tabsurvey | Offline Data Collection | Employee Engagement | Customer Satisfaction.

]]>